by Nicole Scimio | Jul 24, 2024 | Blog, Investment Rental Property, Owner Resources, Property Management Education, Uncategorized

Investing in Rental Properties

So, you’ve decided that you want to invest in rental properties, but aren’t exactly sure what kind of property is right for you. Don’t worry, we’re here to help!

To make it as simple as possible, you have essentially 3 different asset classes to choose from:

The purpose of this article is to explain each type of the 3 main asset classes when investing in rental properties, cover the pros and cons of each, and hopefully help you decide what’s right for your investment needs.

Single-Family Property

Definition: A single-family home is a free standing residential building designed to be used as a single-dwelling unit.

Pros of Single-Family Properties:

- Tend to attract renters who stay longer, reducing turnover

- You’re often able to make the resident responsible for utility expenses

- The value of the property is not necessarily dependent on the rental income that it generates

- Fairly easy to sell

- Widely available

- Will potential rent at a higher rate than a multi-family counterpart

- Resident usually responsible for all landscaping and snow removal at the property

Cons of Single-Family Properties:

- When you do have turnover, there’s only one unit so you have zero income from that property during turnover

- They’re typically more expensive on a per-unit basis because you’re only purchasing one unit (for the same price as a duplex, for example)

Multi-Family Property

Definition: A multi-family property is a property with 2 or more residential units.

Pros of Multi-Family Properties:

- You can typically realize efficiencies of scale – you have one roof over multiple units

- Each unit often has the same floor plan as well

- Turnover time tends to be lower because they’re usually smaller than single-family

- Typically easy to rent – there will always be someone looking for a one bedroom apartment

- Cost per unit to purchase tends to be lower than single-family

- If one of the units is vacant, you still have the ability to generate rental income from the other occupied unit(s)

Cons of Multi-Family Properties:

- Often more difficult to find

- Typically smaller units, which lead to higher turnover rates (usually only 1-2 bedrooms)

- Attracts singles or someone with a roommate, shorter overall average residency

- Often have shared utility expenses

- For example, one water meter for a two-unit duplex

- Value of the property is oftentimes directly correlated to the income that the property generates

- Value of property directly relates to rental prices you have (value depending on the rent)

- Increased risk of disputes between tenants

- Usually shared common spaces

- Shared lawn or shared sidewalk means owner is responsible for snow removal and lawn care

Condominiums (Condos)

Definition: Condominiums (or condos, for short) are an ownership structure whereby a building is divided into several units that are each separately owned (via Wikipedia.com).

Pros of Condominiums:

- HOA fees – oftentimes, they’re inclusive of exterior maintenance (roof leak, condo association will pay for it) making monthly expenses more predictable

- Don’t have to worry about landscaping

- Neighbors are more likely to have higher level of respect for the property giving a greater sense of community

- Oftentimes in desirable locations

- Could lead to making units more attractive to potential renters

- Some offer amenities like a gym, pool, tennis court, etc.

- Another factor that can make units more attractive to potential renters

Cons of Condominiums:

- HOA fees – could cut into monthly cash flow

- Sometimes the HOA has limitations or restrictions on how many units can be rented within the association or imposes fees for rental registration

- Can be difficult to insure

- Shared common areas or shared walls with other condo owners

- An elected HOA board makes the decisions for the community, politics are often involved

Overall…

When choosing an asset class to invest in, there are pros and cons to each.

As an investor, you have to evaluate each of those and determine what’s best for your particular investment strategy.

However, if you’d like to discuss any of this further, or need help finding out which type of asset class is the best option for you and your investment strategy, please contact us for a free consultation!

by Nicole Scimio | Jun 20, 2024 | Blog, Investment Rental Property, Low Income Tax Credit Housing, Owner Resources, Project Based Section 8 Housing, Property Management Education, Tenant Education

The Differences Between Market-Rate and Affordable Housing

If you’ve been involved in the housing industry for any period of time, you’ve probably heard the terms “market-rate housing” and “affordable housing.” But what exactly is the difference between the two? Don’t worry, we’ll break it down for you.

Market-Rate Housing

Market-Rate Housing is also known as conventional housing. This just means that the property does not have any type of subsidy, and the resident pays the full amount of the rent that is determined by the market.

Attributes of Market-Rate Housing:

- The lease terms are customizable

- No restrictions on additional services and fees you are able to provide to the tenant

- You can non-renew a lease for any reason

- The rent is not guaranteed (residents may or may not pay, might be late on rent)

- Late payments/refusal to pay could lead to eviction

- You can create your own screening criteria

- There’s no limit on the rental amount that you can charge

- Rent is dictated by what someone is willing to pay for the unit

If you want to check out our available market-rate properties, click here.

Affordable Housing

Affordable Housing is also known as subsidized housing, meaning that the property is receiving a subsidy from a governmental agency whereby the resident is only responsible for a portion of the rent. This portion of the rent that they owe is typically based on their income.

Attributes of Affordable Housing:

- Lease terms are subject to the agency issuing the subsidy

- The rental subsidy payments may be subject to property inspections from the agency

- You are limited in reasons for non-renewing a lease

- The rent is guaranteed by the agency issuing the subsidy

- Your screening criteria is also dependent on the agency that’s issuing the subsidy

- The rental amount is dictated by the agency that’s issuing the subsidy

- There are income restrictions for residents to qualify

If you want to learn more about the different types of Section 8, check out this blog post.

If you want to check out our available affordable housing properties, click here.

All in All

Whether the property is market-rate or affordable housing, our primary goal is still the same: to provide safe and habitable housing for all of our residents, as well as professional management services to meet our clients’ goals for any property that we manage.

We have 40+ years of expertise in all aspects of housing in and around the Pittsburgh area, Western Pennsylvania, and West Virginia, so if you have any questions, feel free to contact us!

by Arbors Management, Inc. | Aug 9, 2019 | Investment Rental Property, Property Management Education

The Pittsburgh Housing Market

There are plenty of excellent reasons to invest in Real Estate in Pittsburgh:

- Pittsburgh is diverse

- Pittsburgh is growing and desirable

- Plenty of good school districts nearby

- Pittsburgh real estate is generally affordable

The list could go on and on!

Whether you’re local to the area or from out of state and looking for an investment property, you can find some thriving submarkets in and around Pittsburgh.

Today, we’re talking about what you should buy and where you should buy when considering a Pittsburgh investment property.

Investing in Pittsburgh: Market Strength

Housing prices are on the rise in Pittsburgh, but the buy-in that investors face is still much lower than in other east coast cities.

Pittsburgh neighborhoods have undergone a lot of revitalization in the last few years, and the economy is growing.

More people are moving into the area and unemployment is lower than the state average.

There’s a growing tech industry in the city thanks to companies like Google, Apple, Uber, and Facebook setting up shop.

The medical centers and universities are putting Pittsburgh on the map in new ways, and smart investors are taking note.

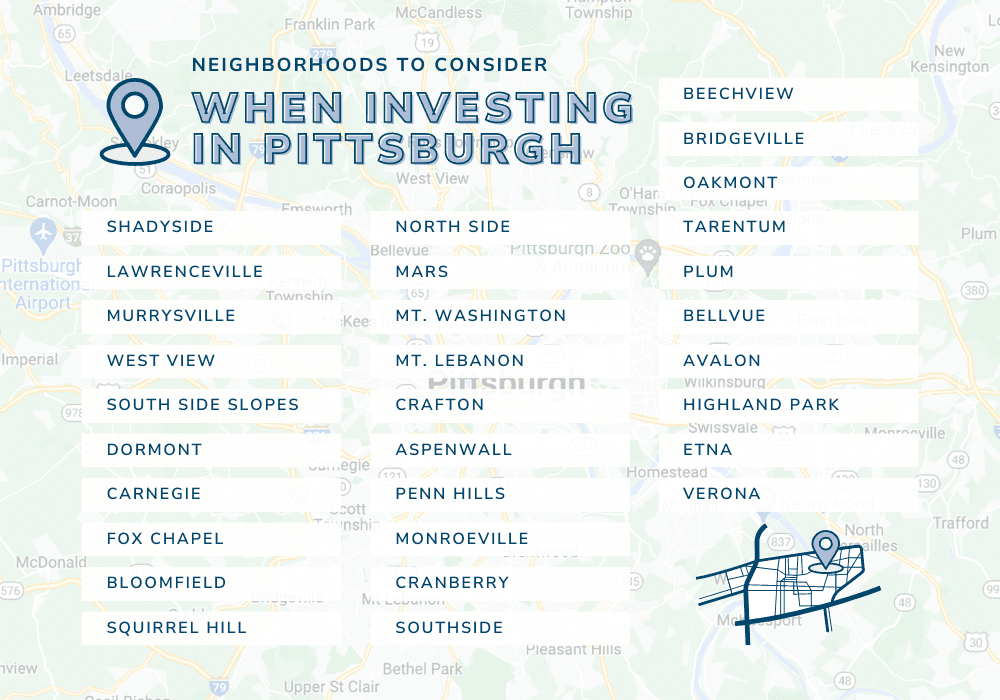

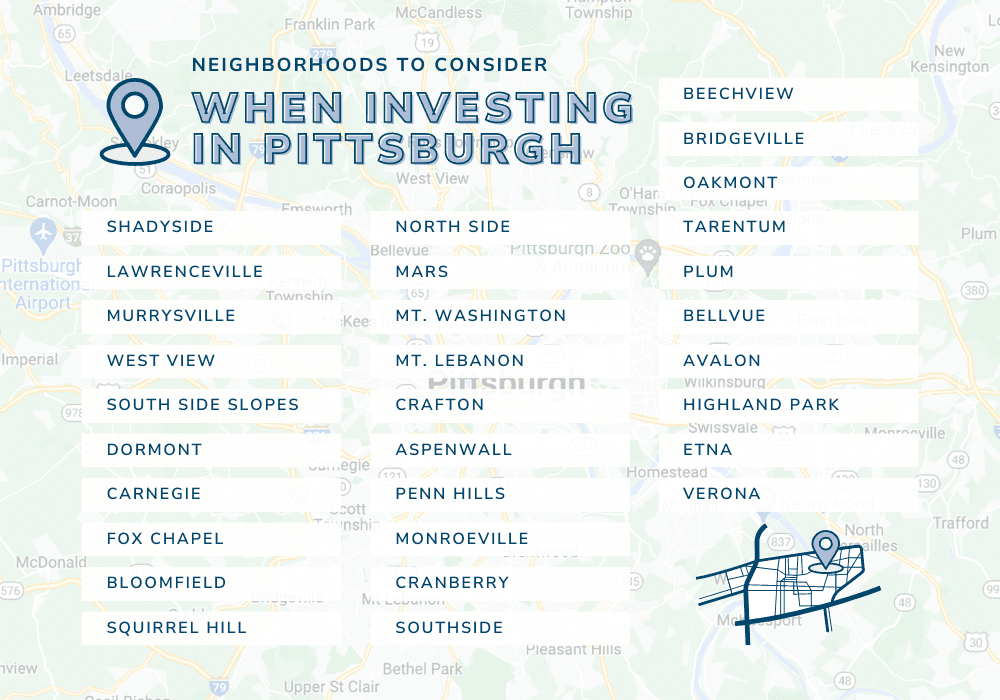

Pittsburgh Neighborhoods to Consider

When you’re looking for a Pittsburgh investment property, you’ll need to consider your investment goals and the importance of location.

When we’re talking to investors, whether they’re looking for their first rental home or an additional property to add to a growing portfolio, we always recommend neighborhoods with outstanding resident pools and the potential for long term gains.

Some of those neighborhoods we recommend are:

Pittsburgh Neighborhoods to Avoid

As your property management partners, we care about the investment decisions that you make and are happy to be involved from the beginning.

If you’re considering purchasing a home in Pittsburgh, reach out to us to get our insights on the neighborhood – we’ll give you our honest feedback.

Types of Homes to Buy

When you’re looking for a great investment property in Pittsburgh, remember that your goal is to get it onto the market as soon as possible – an unoccupied rental home is an expensive rental home.

So, look for properties that are in good shape.

Cosmetic upgrades often just take a few days, and it’s fine to buy a home that needs new paint or better flooring.

Don’t bother with properties that will require heavy renovations and rehab work; you’ll lose too much money on vacancy costs, and you may not recoup what you spend bringing it up to habitability standards.

40+ Years of Experience in the Pittsburgh Housing Market

With over 40 years of experience in the Pittsburgh housing market, we’ve learned a thing or two – we’d be more than happy to discuss your options as a potential or current owner in Western Pennsylvania!

For more information or a free consultation, please contact us at Arbors Management.

by Arbors Management, Inc. | Jul 10, 2019 | Blog, Investment Rental Property, Property Management Education

What to Look for In a Property Management Company in Pittsburgh, PA

Property managers often get a bad rap. Why?

Because until recently, the work of a property manager wasn’t taken seriously.

The industry was undeveloped and there wasn’t a lot of training and technology, which led to distrust and bad practices.

But, things are changing.

There’s been a lot of innovation and investment in the property management field, and the best property managers today are doing a lot more than collecting rent and placing residents. We’re managing assets.

(more…)

by Arbors Management, Inc. | Jun 10, 2019 | Blog, Investment Rental Property, Property Management Education

So Which Is Best: Renting Out or Selling My Home?

We frequently talk to homeowners in Pittsburgh who are moving into a different home or leaving the area for work or other responsibilities who aren’t sure what to do with their property.

Deciding whether you want to sell or rent out your property is a very personal decision and there’s no single answer.

Your decision will depend on a number of factors – contrary to what you might believe, though, not all of these factors involve finances!

Today, we’re going to share some of the points we talk through with owners who are deciding between renting out or selling their home.

#1: Consider Short and Long Term Financial Goals and Needs

If you need some immediate cash fast, it’s better to sell your property.

Renting out a home can build wealth and earn you incredible profits, but it’s not going to happen right away.

You need to settle into a long term investment strategy in order to make real money.

So, if you’re looking for money to use as a down payment on a new home, you want to invest elsewhere, put a child through college, etc.; selling is better for you right now.

However, when you don’t have an immediate need for the equity that’s in your property, it might be better for your financial future to rent out the home.

You’ll earn some regular cash flow and hold onto your asset while it continues to appreciate in value.

Long term investors will earn more by renting out the property.

#2: Think About the Value of a Great Tenant and a Maintained Home

As a rental property, your home has the potential to earn your regular income.

A property with positive cash flow has higher earnings than expenses.

For example:

if you rent out your home for $1,500/month, your mortgage payment is $800 per month, and your taxes, insurance, and other expenses add up to $300 a month, you’re earning a pretty healthy cash flow.

$1,500 / month Your rental rate

-$800 / month Mortgage payment

-$300 / month Taxes, insurance, other expenses

$400 / month Cash flow

Even if you’re breaking even with your income and expenses, remember that there are still several benefits to renting out your property:

- Your resident is paying down your mortgage

- Your asset is increasing in value

- Your resident is taking care of the property

If you’re preserving the condition of your property and keeping it occupied with great residents who pay rent on time and follow the terms of your lease, a rental will provide income and ROI for as long as you own it.

#3: Consider Renting the Property for Tax Benefits

Don’t forget the tax benefits of renting out a property!

When you sell a home, you may have capital gains taxes to absorb.

However, when you rent out your property, you can protect yourself from a lot of tax liability.

Depreciation is a deduction you can take, and you can also deduct the costs of maintaining your home.

Additionally, professional services like property management are tax-deductible.

#4: Don’t Forget to Take Emotions into Account

When it comes to a home, there are also some emotional elements involved.

If you can’t bear the thought of someone else living in your home while you’re still attached to it, it may be better to sell and move on.

If you might return to the Pittsburgh area at some point in the future, keep it so you have a place to live when you come back.

We’re Here to Help

We’d be happy to talk through these issues with you, and to figure out the solution that will make the most sense for your bottom line and your peace of mind.

Contact us at Arbors Management today!

by Arbors Management, Inc. | May 10, 2019 | Blog, Investment Rental Property, Property Management Education

Every Investor’s Burning Question

Much like snowflakes, every rental property is unique.

But, while you might have an idea of how much your investment property is worth, you still have to ask yourself:

In reality, how much rent can I actually earn from my property?

The answer to this question is based on a number of factors:

- The Pittsburgh rental market

- Property location & pricing

- Size and condition of the property

Some of these factors are within your control, while others are not.

Let’s take a look at how each of these factors plays a role in determining your rental property’s value and what you can do to maximize your rental income.

The Pittsburgh Rental Market

One of the things you have no control over is the strength of the current rental market.

Obviously, you’ll hope to earn enough to cover your mortgage and other expenses, all while earning a bit of extra cash every month.

But ultimately, the price you place on your rental home will depend on what’s going on in the rental market – and whether there’s a demand for homes like yours.

Before you price your property, make sure you take a look at the market.

Get to know what homes similar to yours and in your area are renting for.

Do a comparative analysis so you know how your own home measures up.

The whims and preferences of renters often change, and residents are more educated than ever; qualified renters won’t be willing to pay more than what the market dictates.

Property Location and Pricing

Another consideration is location; your property’s location will influence its price.

If you have a single-family home in a neighborhood with a good school system, you’ll be able to charge a lot more than if your property was in a less desirable zip code without access to good schools, commuter routes, shopping, and recreation.

As a general note, properties that are more remote will often rent for less.

Once you’ve bought a property, you don’t have much control over its location; but, location is something to take into account when you’re considering an investment.

Size and Condition of the Property

The size of your home will also impact the price.

For single-family homes, a three-bedroom, two-bathroom home is usually going to earn more than a home with just one bathroom or two bedrooms.

However, a condo or loft space downtown doesn’t need the three bedrooms in order to bring in top dollar rents. In that case, amenities will make more of a difference.

Property condition is actually a factor that you can control; when you allow your property to look worn out and run down, you’re losing rent money.

When considering the condition of your property, an important question to ask yourself is, “Would I live here?”

If your answer is no, you may need to consider some strategic renovations or upgrades that could make your property more desirable.

You’ll be able to charge more in rent when you provide fresh paint, new floors, and even simple improvements like new faucets in the kitchen and bathrooms.

Replace your drawer pulls with brushed nickel, install better lighting, invest in replacing old and nearly-broken appliances with energy-efficient models.

Not only will these minor investments raise your rent, they’ll also attract better residents.

Need Personalized Advice on How Much to Charge in Rent?

We can help!

We’re experts in pricing rental properties in the Pittsburg market. Contact us at Arbors Management for a free consultation and to learn more today!