by Andrea F | Dec 8, 2025 | Blog, Featured Posts, Uncategorized

Unveiling the Holiday Magic of Pittsburgh

Pittsburgh becomes a stunning destination during the Christmas season, offering many activities that include beautiful light displays, festive markets, and theatrical performances that showcase unique local experiences. Here’s a list of some must-see attractions in this wonderful city:

Ice Skating at the UPMC Rink at PPG Place

Experience the joy of skating at the Pittsburgh Ice Rink, located at PPG Place, where a magnificent Christmas tree stands proudly at its heart.

Pittsburgh Ballet Theater

A cherished tradition for many in Pittsburgh! Watch Marie and the Nutcracker Prince as they embark on an unforgettable journey through the snow into the enchanting Land of Enchantment.

Peoples Gas Holiday Market

Join in the festive spirit at the annual Peoples Gas Holiday Market in Downtown Pittsburgh. Here, you can find gifts for others (or yourself), enjoy live music, and wander through an illuminated Market Square filled with charming wooden chalets showcasing high-quality gifts and holiday experiences enriched with international flair and local character.

Kennywood Park Holiday Lights

Amusement parks aren’t only for soaking up the summer sun while riding roller coasters. Experience the magic of the Kennywood Holiday Lights at this historic amusement park! With over two million sparkling lights, merry rides, and let’s not forget, Pennsylvania’s tallest Christmas tree, it’s a festive spectacle not to be missed!

Phipps Conservatory and Botanical Gardens

Experience Phipps Holiday Magic! This year’s theme, “Wild Winter,” welcomes you to a whimsical wonderland filled with delightful gardens and captivating scenes at every corner. Inside, you’ll discover new displays featuring stunning displays and floral masterpieces. Don’t miss the outdoor Winter Light Garden, showcasing an array of illumination.

Dazzling Nights at Pittsburgh Botanic Garden

Put on your comfy shoes and prepare for a mile-long stroll. Enjoy a stunning natural wonderland with a million lights. Discover enchanting attractions like tunnels of stars, vibrant forest creatures, and the captivating charm of nightly snowfall. Plus, enjoy live entertainment throughout the evening. This is an enchanting experience you won’t want to miss!

Captivating Holiday Window Displays

You’ll never run out of things to do during the Christmas season in Pittsburgh, with so much entertainment and activities available to share with family and friends. In fact, we couldn’t possibly list them all. Whether you decide to enjoy one, a few, or all of these fun options, you’re bound to be wonderfully impressed.

Wishing you Happy Holidays from all of us at Arbors Management!

by Andrea F | Nov 11, 2025 | Blog, Featured Posts, Owner Resources, Property Management Education

Understanding the Criteria for Assistance Animals in Rental Housing

Navigating the complexities of assistance animals in rental properties can be challenging for both landlords and tenants. The regulations are primarily dictated by federal laws, such as the Fair Housing Act (FHA), rather than individual landlord preferences or blanket “no pets” policies.

Here’s a concise overview of the essential criteria and requirements for allowing an assistance animal in a rental property.

-

Assistance Animal vs. Pet

The first key distinction is that an “assistance animal” is not classified as a pet. Instead, it is an animal that works, assists, or performs tasks for someone with a disability. It may also offer emotional support that alleviates symptoms or effects of that disability. Under the FHA, landlords are required to make reasonable accommodations for individuals with disabilities. This can include permitting assistance animals even in the presence of a “no pets” policy, unless it poses an undue burden or direct threat.

-

The Definition of Disability

According to the FHA, a person with a disability is defined as an individual with a physical or mental impairment that significantly limits one or more major life activities. The accommodation pertains to the individual’s disability, and the animal plays a crucial role in that accommodation.

-

The Two Main Types of Assistance Animals

There are two primary categories of assistance animals:

Service animals are typically dogs specifically trained to perform tasks directly related to a person’s physical, sensory, psychiatric, intellectual, or other mental disabilities. Examples include guide dogs for the visually impaired, hearing dogs, or dogs trained to detect seizures.

-

- Key Point: For service animals, landlords cannot inquire about the individual’s disability, require a demonstration of the animal’s training, or request documentation of the disability or training.

-

Emotional Support Animals (ESAs)

ESAs provide emotional or mental support that alleviates the symptoms of a disability, but they do not require specialized task-oriented training. The focus here is the therapeutic benefit the animal delivers to the individual’s well-being.

-

- Key Point: For ESAs, landlords can request reliable documentation confirming the individual’s disability (but not the specific disability itself) and the necessity of the animal, typically in the form of a letter from a qualified healthcare professional.

-

Documentation and Verification

Landlords may seek verification for an ESA if the disability is not immediately apparent. This documentation should:

- Be supplied by a healthcare professional (doctor, therapist, psychiatrist, social worker, etc.) treating the individual for their disability.

- Confirm that the individual has a disability as defined by the FHA.

- Indicate that the animal is necessary for support or tasks related to that disability.

- Important: The documentation does not need to specify the exact disability, just its presence and the need for the animal as part of the accommodation.

-

Reasonable Accommodations and Exceptions

Landlords must allow the animal unless specific conditions are met. They can deny a request for an assistance animal if it can be demonstrated that:

- The animal poses a direct threat to the health or safety of others that cannot be mitigated by other reasonable accommodations.

- Granting the request would create significant administrative or financial burdens (an “undue burden”).

- The animal would cause substantial physical damage to the property of others.

- Note: Allergies or a generalized fear of animals from other tenants are typically not sufficient grounds for denial under the FHA.

-

Tenant Responsibilities

While landlords are obligated to accommodate the animal, tenants remain responsible for:

- The animal’s behavior (e.g., preventing excessive noise or damage to common areas).

- Cleaning up after the animal (waste disposal).

- Any damage caused by the animal that exceeds normal wear and tear.

In summary, the criteria for assistance animals in rentals focus on a verified need associated with a disability. Not the animal’s training or classification as a “pet.” Understanding these federal guidelines promotes compliance and fair practices for all parties involved. Should you have further questions about this subject in relation to your investment properties, or if you prefer someone to handle this for you, we are here to help! Please reach out to us at 1-800-963-1280 or at contact@arbors.com.

by Andrea F | Oct 14, 2025 | Blog, Featured Posts, Press Releases, Property Spotlights

Find Your Perfect Home in Coraopolis, PA

By: Andrea Faulk

Gallery Gardens

This beautifully renovated apartment building is a luxurious new addition to Coraopolis, PA, offering an opportunity you won’t want to miss. With 29 units available, here are some of the fantastic amenities you can enjoy:

- A modern gym

- Ample storage space

- An outdoor garden gazebo

- Indoor and outdoor security systems

- Striking 10-foot ceilings

- A private dog park

- And much more!

Conveniently located just 8 miles from Pittsburgh Airport, this property is ideally positioned in the business district, close to shops, restaurants, and various amenities!

We are excited to announce that we are now accepting applications and deposits. Don’t miss out on the opportunity to discover your perfect home! Reach out to Vivian, the Senior Portfolio Manager & Leasing Specialist at Gallery Gardens, Arbors Management, Inc.

📧 Email: VivianP@arbors.com

📲 Phone: 412-254-8056

Our Open House is coming up soon! Stay tuned and check out our Facebook page, Instagram, or website for further details.

by Andrea F | Oct 1, 2025 | Blog, Featured Posts, Investment Rental Property, Low Income Tax Credit Housing, Project Based Section 8 Housing, Property Spotlights, Uncategorized

By: Andrea Faulk

Arbors Management is well-known for its impressive and consistent growth year after year. Recently, they have partnered with the new ownership team of the Towne Towers building in Oil City, Pennsylvania, as part of their latest expansion efforts.

This collaboration aims to implement significant enhancements to the building and the surrounding community. With over 40 years of expertise in property management, Arbors Management is dedicated to preserving and improving Affordable Housing in Pennsylvania, West Virginia, and Ohio.

In July 2022, Arbors Management, Inc. assumed management of Towne Towers. Since then, numerous positive changes have been introduced, including the hiring of full-time office and maintenance staff to better serve residents.

In collaboration with the new ownership team, Arbors Management, Inc. plans to invest more than $2,000,000 in renovations and upgrades for the building. This initiative aims to enhance the living experience for both current and prospective residents.The planned upgrades include:

- A new roof

- Modernized elevators

- An upgraded fire panel

- New kitchens and bathrooms

- Full building Wi-Fi

- A new camera system

- New HVAC systems

- Improved accessible units

- And much more!

Towne Towers is a 100-unit Project-Based Section 8 apartment complex designated for elderly and disabled individuals, conveniently located in the heart of Oil City, Venango County. To learn more about Towne Towers, please visit our website.

If you are interested in becoming a resident of Towne Towers, feel free to call 814-676-9315 or email TowneTowers@Arbors.com.

by Andrea F | Aug 12, 2025 | Blog, Featured Posts, Investment Rental Property, Owner Resources, Property Management Education, Rent Collection, Rental Price

Investing in Real Estate? The Case for Professional Property Management

By: Andrea Faulk

Real estate investment is often heralded as an excellent avenue for generating passive income. However, the reality of being a landlord can quickly turn that “passive” income into an active and demanding endeavor. Managing properties involves a multitude of tasks that can be both time-consuming and stressful. This is where a professional property management company can become an invaluable asset for investors.

Here’s a deeper look into why experienced investors often choose to partner with property management experts:

1. Expertise and Efficiency for Optimal Returns

-

Tenant Screening and Placement: Finding reliable tenants is crucial. Property management companies use comprehensive screening processes, including background and credit checks, employment verification, and rental history evaluations, to ensure quality residents occupy your property.

-

Optimal Rental Pricing: Setting the right rent requires a delicate balance. Property management companies conduct thorough market analyses to competitively price rentals, maximizing income while minimizing vacancies.

-

Effective Marketing: Ensure that marketing reaches the right audience to successfully fill vacancies with the ideal candidates.

2. Time Savings and Stress Reduction

-

Delegating Day-to-Day Operations: Managing a property can feel like a second full-time job. A property management company handles everything from maintenance calls to rent collection, freeing up your time for other ventures.

-

Streamlined Processes: Property management companies establish efficient systems for rent collection, maintenance requests, and accounting. They often offer online portals for tenant payments and financial reporting.

-

Peace of Mind: Knowing professionals are handling all aspects of your investment offers peace of mind, allowing you to enjoy ownership benefits without the headaches.

3. Protecting Your Investment and Minimizing Risks

-

Legal Compliance: Landlord-tenant laws are complex and ever-changing. Property management companies stay informed on legal requirements, ensuring compliance and reducing the risk of costly lawsuits or penalties.

-

Preventive Maintenance: Regular inspections and proactive maintenance are vital for preserving property value. Property management companies schedule routine maintenance and address repairs promptly, often with access to discounted contractor rates.

-

Dealing with Difficult Situations: Property management companies have the experience to handle challenging situations like late rent payments or evictions, minimizing financial losses and emotional strain.

4. Enhanced Tenant Retention and Satisfaction

-

Prompt Responses to Needs: Quick response to tenant concerns and maintenance requests leads to higher tenant satisfaction and retention, reducing turnover and vacancies.

-

Improved Tenant Relations: Professional and consistent tenant interactions foster positive relationships, leading to longer tenancies and a stable income stream.

In summary, although self-management may seem like a cost-effective option, the time investment, legal liabilities, and risk of expensive errors can outweigh any perceived financial benefits. Engaging a professional property management company enables you to utilize their expertise, enhance operational efficiency, safeguard your investment, and optimize your returns, all while enjoying a more passive income stream. A property management company can truly become your most valuable asset.

If you need help managing your property, that’s what we’re here for! Please reach out to us at 1-800-963-1280 or at monroeville@arbors.com.

by Andrea F | Jun 18, 2025 | Blog, Featured Posts, Low Income Tax Credit Housing, Press Releases, Project Based Section 8 Housing

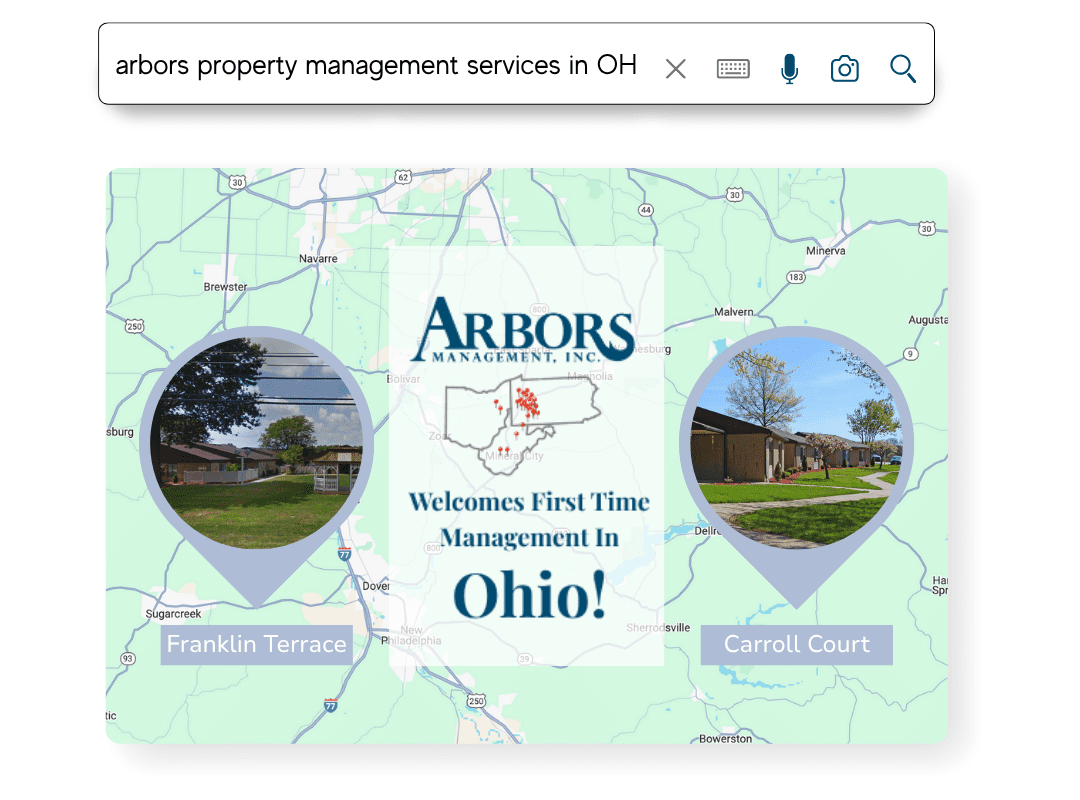

Arbors Management Expands to Ohio- We are thrilled to share the news of our recent management of two new Senior/Affordable Housing properties: Carroll Court and Franklin Terrace, situated in Carrollton and Strasburg, Ohio. This represents Arbors’ first management venture in the state of Ohio, and we are immensely proud of our continuous growth and accomplishments.

Situated in Carrollton, OH, Carroll Court features 60 single-story, garden-style units featuring one and two bedroom units. This property sits in a beautiful setting with a wonderful community building, and plenty of outdoor space, along with storage units for each apartment.

Just a short drive away, in Strasburg, Ohio, lies Franklin Terrace Senior Apartments. This community features garden-style units, offering a total of 79 one and two bedroom apartments. Each equipped with private patios perfect for relaxation, along with a spacious community room for gatherings.

With new ownership and management in place, these properties will undergo nearly $1.5 million dollars in upgrades over the coming twelve months including new roofs, new parking lots, new kitchens, accessibility upgrades, mechanical upgrades, community room upgrades, and more!

Since 1982, Arbors Management, Inc. has developed a portfolio of over 4,000 residential units, encompassing both Market-Rate and Affordable Housing, throughout Western PA and West Virginia, and now Ohio. We are eager to continue growing in all regions. Everyone at Arbors Management is excited about this expansion and looks forward to what the future holds!

If you’d like to explore how Arbors Management can help you manage your property, please visit our website to learn more about our services at our website.